- The Standard Risk Measure (SRM) and its continuing value to members

- The definition of “risk” for a superannuation fund member

- Viewing risk from the perspectives of Trustees

- Measuring risk for retirees

- Traditional risk measures in the context of long horizon superannuation fund investing

- Risks of unlisted investment assets

- The importance of investment time horizons in measuring investment risk

- The different investment risks faced by accumulation and pension members

- Investment risk for super funds

- Sequencing risk

- Longevity risk

- Moving towards addressing retirement risks for superannuation fund members

- The key risks as members approach and enter retirement

- Life cycle strategies – Making sense of Life Cycle Investment options.

- Unlisted asset investments

- Valuations of unlisted assets

- The risks of unlisted assets

- Risks from the Trustee perspective

- The risks to superannuation fund members of inadequate advice

- Member advice in a perfect world and the importance of advice in reducing risk to members

2024 Sponsorship & Speaking Opportunities:

Superannuation Risk 2024 Forum offers sponsors an excellent opportunity to demonstrate thought-leadership and leverage networking opportunities to build brand-value amongst your target audience. If you would like to know more about sponsorship, exhibition and business development opportunities please just get in touch with us- sponsorship@ibrc.com.au

DELEGATE REGISTRATION & COFFEE

STEPHEN HUPPERT

Independent Consultant & Advisor

Trustees of superannuation funds are in the business of managing a very broad array of risks. In the fiduciary relationship of managing other people's money, the law is oriented towards ensuring that members and the financial system are protected from the consequences of a wide range of risks.

• The importance and benefits of risk taking in personal and business contexts;

• The very wide range of risks that the financial system, trustees, and members are exposed to;

• Not all risks are alike, and what kinds of risk can trustees adopt greater appetite or tolerance; and

• How an appropriate control mix can empower risk taking with confidence.

JONATHAN STEFFANONI

Managing Partner, Legal & Prudential

• Liquidity risk

• Valuation risk

• Tracking error under the Your-Future-Your-Super performance test

• Impact on rebalancing and portfolio shape

• Governance challenges

DAVID BELL

Executive Director, The Conexus Institute

• What role do alternative investments play in managing investment risk for super funds, and what are the associated challenges?

• Implementing the revised SPS 530 on Investment Governance

• What are the considerations for super funds when selecting and monitoring external investment managers to ensure effective risk management?

MODERATOR:

SANDI ORLEOW

Trustee Director, Active Super

PANEL MEMBERS:

STEPHANIE LYONS

General Manager, Investment Risk, Rest

MOHAMED AHMED

Senior Consultant, Cutter Associates

10:50 MORNING COFFEE & NETWORKING

• What should superannuation funds be doing to be in a FAR-ready state

ROZ TESKEY

Partner, Deloitte

This session would focus on the ideal vision of a superannuation regulation, the consulting prior to implementing, the implementation from an operational risk and compliance perspective and leading through these changes.

MODERATOR:

AMANDA CHISHOLM

Director - Legal, Risk and Compliance, Kaizen Recruitment

PANEL MEMBERS:

JUSTINE GORMAN

Head of Enterprise Risk Management at Aware Super

GEOFF ROONEY

Partner at BDO in Australia

HAYLEY POPE

Executive Manager, Governance at First Super

10:50 MORNING COFFEE & NETWORKING

• Influence of differing income objectives

• Interpreting ‘sustainability and stability’ of income

• Impact of investment, longevity, inflation and other risks to income

• Role of lifetime income streams in managing income risk

• Soliciting member risk preferences through an income lens

GEOFF WARREN

Research Director, The Conexus Institute and Honorary A/Prof, ANU

• The need for advice

• Findings of the Royal Commission on financial advice

• Why super funds may be well placed to provide advice

• Recognising the limitations of advice by superannuation

funds

SEAN MCGING

Managing Director, McGing Advisory & Actuarial

2:50 AFTERNOON TEA & NETWORKING

How to meet the APRA CPS230 Operational Resilience requirements, this also covers leveraging Cloud Resilience and uplifting critical operations, simulating and testing the failure of all the critical operations within the Bank/Insurance provider.

ARCHANA YALLAJOSULA

Director, Global Enterprise Cloud & Technology Consulting, Protiviti

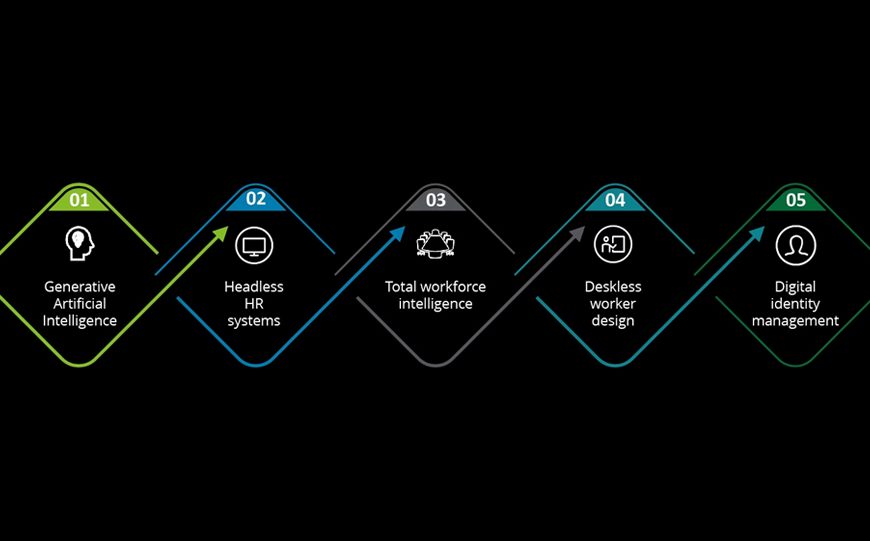

• Importance of embracing technological advancements

to enhance risk management processes.

• Role of Technology in Risk Identification and Assessment

• Utilization of data analytics and artificial intelligence (AI) or identifying and assessing risks

• Implementing Risk Mitigation Strategies through Technology

• Enhancing Cybersecurity Measures

MIA LANDER

Strategic Advisory, KPMG Australia

In an era of increasing digitization, cybersecurity threats pose significant risks to organizations of all sizes. This session will discuss the latest cyber threats, effective cybersecurity measures, incident response strategies, and the role of technology in mitigating cyber risks.

MODERATOR:

JOE MCDAVITT

Director, Operational Risk at Battleground

PANEL MEMBERS:

KAREN STEPHENS

Co-Founder/ Chief Executive Officer at BCyber

CHRIS SELF

Head of Service Delivery at MyEmpire Group

MICHELLE BOWER

Chief Executive Officer at Gateway Network, Governance Body Ltd

CLOSING REMARKS FROM THE CHAIR

1 hour networking drinks

8:20 DELEGATE REGISTRATION & COFFEE

STEPHEN HUPPERT

Independent Consultant & Advisor

SHAWN CHAN

Chief Risk Officer, Brighter Super

MODERATOR:

AMANDA CHISHOLM

Director - Legal, Risk and Compliance, Kaizen Recruitment

PANEL MEMBERS:

SHAWN CHAN

Chief Risk Officer, Brighter Super

LATA MCNULTY

Former CRO at Maple Brown Abbott

• The three lines of defence model has long been a cornerstone of risk management frameworks, but in today's rapidly evolving landscape, is it still the most effective approach?

• As superannuation funds face increasingly complex risks, it's crucial to examine whether the three lines of defence model is adapting to meet these challenges

MODERATOR:

NICOLE OBORNE

Partner, Superannuation & Asset Management Assurance Leader, PricewaterhouseCoopers (invited)

• Whether a merger, a system change or other transformation, most superannuation funds are dealing with a significant change in their business. One of the drivers of success will be how they manage the risks involved.

• Over time and over budget: is it inevitable

• Whose problem is it: the consultant, the vendors, the trustees?

MODERATOR:

MICHAEL QUINN

Senior Partner at Novigi

PANEL MEMBERS:

TERRY KYLE

Executive Director - Delivery at Kyudo

CORA SPEED

General Manager Risk - Superannuation, Iress

• The impact of the Mark McVeigh case

• Implications of ESG on long term investment returns

• Ensuring the fund can demonstrate ESG compliance

• Reputational risk

PANEL MEMBER:

KERI PRATT

Non Executive Director Guild Group & General Manager Defined, State Super

ALEX WISE

Chief Operating Officer, Wealth of Nations

Impact Asset Management

12:40 LUNCH BREAK & NETWORKING

• An interactive session that explores the inherent risks of mindsets and worldviews for effective risk management.

• How mindsets and worldviews affect our listening and perception.

• Ways we use assumptions in sensemaking.

• What this all means for embedding effective risk practices and improving risk culture.

ANDREW BROWN

Director and Co-Founder of Adaptive Cultures

A governance framework that informs and directs enterprise conduct of business in line with its values, standards, settings, and long-term commercial performance.

Three Critical Drivers and Actions:

1.Doing the right thing – by building and evidencing enterprise trustworthiness

2.Setting and incentivizing the targeted behaviours – by aligning conduct of business standards with enterprise

structures, practices, performance and rewards

3.Informing timely governance – empowering a timely management response and remediation to enterprise governance failures across the spectrum of Integrity Risk

PETER HANLON

Founder, ESG MIDOM Solutions

JEFF OUGHTON

ESG MIDOM Solutions

• Different solutions for different members

• The need for tailored solutions to address risk

• Analysing the key risks and their relevance to retirees

• The extent to which the age pension can be the ultimate risk mitigator

MODERATOR:

STEPHEN HUPPERT

Independent Consultant & Advisor

Panel Members TBA

Closing remarks from the chair

Register & pay for 3 delegates & get unlimited registrations* (*Can attend in-person or virtually )

Register & pay for 3 delegates & get unlimited registrations* (*Can only attend virtually)

This site uses cookies. Find out more about cookies and how you can refuse them.