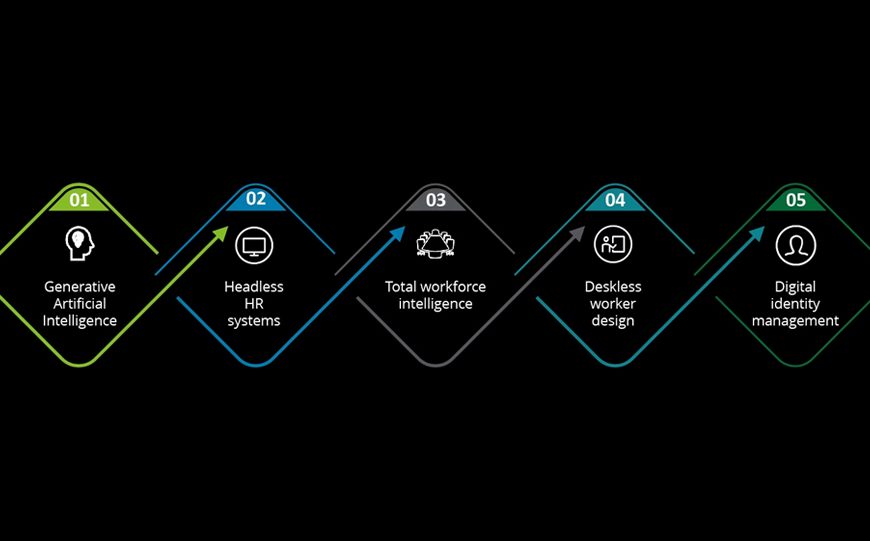

Explore how cutting-edge technologies like Generative AI (Gen AI) and Artificial Intelligence (AI) are transforming the superannuation fund administration landscape. This panel will delve into practical applications, strategic opportunities, and potential challenges, offering insights on how AI can drive efficiency, enhance member experience, and ensure compliance in a highly regulated industry.

• Streamlining Operations with AI

• Enhancing Member Engagement

• Risk Management and Compliance

• Data Insights and Predictive Analytics

• Ethical Considerations and Challenges

• Future Trends in AI for Superannuation

MODERATOR:

CATHY DUNCAN

Senior Consultant, Strategic Sales, Tata Consultancy Services

PANEL MEMBERS:

JOSHUA COOTE

Head of Operational Excellence & Member Administration, Telstra Super Pty Ltd

ALICE TANG

Senior Financial Services Executive

ANDY TAYLOR

Head of Cyber Security, Vision Super

10:30 MORNING COFFEE & NETWORKING